The world is changing rapidly, and with it, the risks businesses face are becoming more complex and unpredictable. Traditional risk management approaches are often struggling to keep up. Enter Artificial Intelligence (AI), a game-changer with the potential to revolutionize how we identify, assess, and mitigate risks.

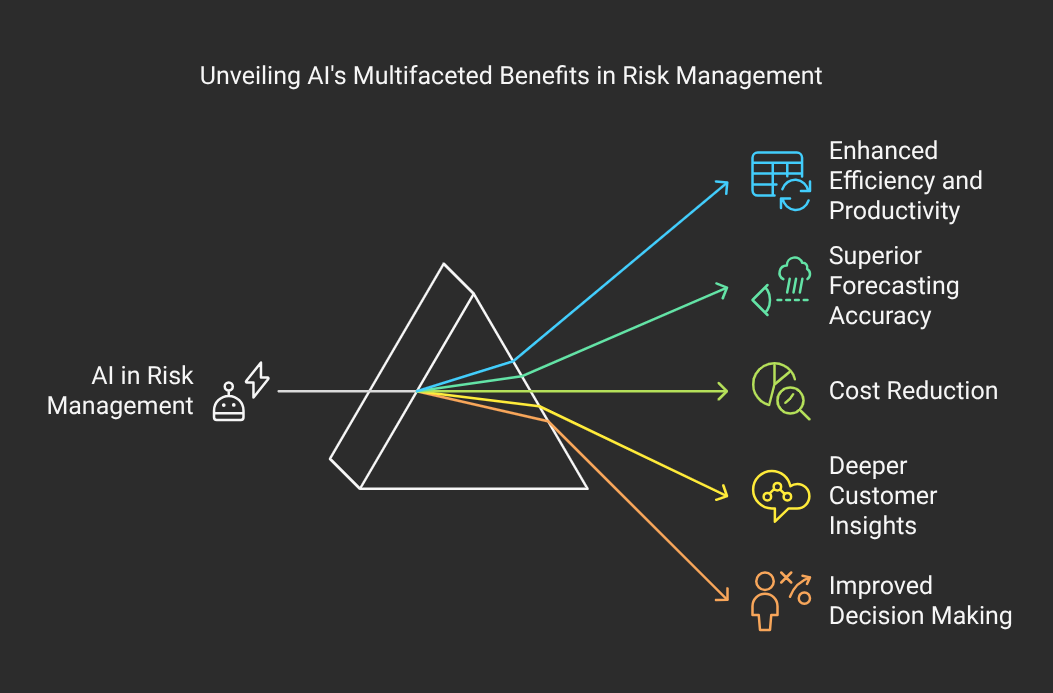

I believe in harnessing the power of AI to enhance risk management strategies. Here are five key advantages of incorporating AI into your risk management framework:

1. Enhanced Efficiency and Productivity:

Tired of manual, time-consuming risk assessments? AI and Machine Learning (ML) can automate data analysis, freeing up your team to focus on strategic decision-making. Imagine processing vast amounts of data with minimal human intervention, leading to faster and more efficient risk identification and assessment. This applies to both back-office functions like regulatory compliance and front-office operations like customer risk profiling.

2. Superior Forecasting Accuracy:

Traditional risk forecasting methods often rely on historical data and assumptions that may not hold true in a dynamic environment. AI-powered techniques can analyze complex patterns and provide more accurate predictions, enabling you to anticipate and mitigate potential threats proactively. This is particularly valuable for credit risk modeling, where AI can explore data and predict crucial credit risk characteristics.

3. Cost Reduction:

Implementing AI in risk management can lead to significant cost savings. By automating processes and streamlining operations, AI/ML solutions can reduce operational, regulatory, and compliance costs for financial institutions and businesses across various sectors.

4. Deeper Customer Insights:

AI/ML solutions can generate vast amounts of accurate data in a timely manner. This allows you to develop a comprehensive understanding of your customers, including their risk profiles and behaviors. These insights can be used to implement targeted risk mitigation strategies and reduce potential losses.

5. Improved Decision Making:

AI’s ability to analyze data, predict outcomes, and generate actionable insights empowers you to make better decisions across all levels – strategic planning, operations, and daily tactical choices. This is particularly valuable for investment and business-related decisions, enabling you to navigate uncertainty with confidence.

The Future of Risk Management is AI-Driven:

AI is no longer a futuristic concept; it’s a present-day reality that’s transforming risk management. By embracing AI-powered solutions, your organization can gain a competitive edge, reduce costs, and make better decisions in the face of uncertainty.

Disclaimer: While AI offers significant advantages for risk management, it’s important to be aware of potential risks associated with its implementation. Future blog posts will explore these risks and discuss strategies for mitigating them

Leave a Reply