Artificial intelligence (AI) isn’t just changing the world around us; it’s also transforming how we manage the risks that come with those changes. With the rapid advancement of technology, AI now offers a powerful arsenal of techniques that can be directly applied to identify, analyse, and mitigate risks across various sectors. From finance to healthcare, the potential applications of AI in risk management are vast and varied.

I’m excited about the potential of these techniques to enhance risk management strategies significantly. Let’s explore some of the key AI methods that are reshaping the field, along with real-world applications that illustrate their impact:

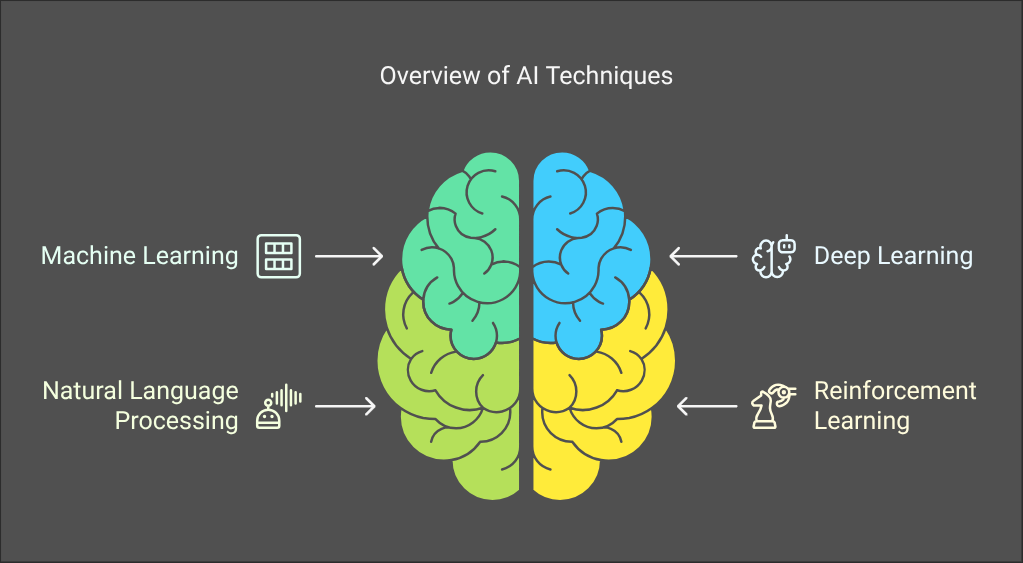

1. Machine Learning (ML): The Pattern Recognition Powerhouse

Machine learning algorithms excel at recognising patterns in vast amounts of data. In risk management, this translates to several practical applications:

- Predictive Modeling: ML can analyze historical data to identify trends and predict future events, such as credit defaults, fraud, or operational disruptions.

- Anomaly Detection: By learning normal behavior patterns, ML can quickly identify unusual activities that may indicate potential risks, such as cyberattacks or insider threats.

- Classification: ML can classify risks based on their severity, likelihood, and potential impact, aiding in prioritization and response planning.

2. Deep Learning: Delving Deeper into Complexity

Deep learning, a subset of ML, uses artificial neural networks to analyse complex, unstructured data like images, text, and audio. This opens up new possibilities for risk management, allowing organisations to tap into previously untapped data sources:

- Unstructured Data Analysis: Deep learning can extract valuable insights from sources like social media posts, news articles, and customer reviews to identify emerging risks or sentiment shifts.

- Image and Video Analysis: In industries like security and surveillance, deep learning can analyze images and videos to detect anomalies or potential threats in real-time.

- Natural Language Processing (NLP): NLP can be used to analyze text-based data like contracts, legal documents, and customer communications to identify potential risks or compliance issues.

3. Natural Language Processing (NLP): Understanding the Human Factor

NLP focuses on enabling computers to understand and process human language. In risk management, this can be applied in various ways that benefit organisations:

- Sentiment Analysis: Analyze customer feedback, social media posts, and news articles to gauge public sentiment and identify potential reputational risks.

- Fraud Detection: Detect fraudulent activities by analyzing communication patterns and identifying suspicious language or behavior.

- Compliance Monitoring: Monitor internal and external communications for compliance with regulations and ethical guidelines.

4. Reinforcement Learning: Learning by Doing

Reinforcement learning involves training AI agents to make decisions in complex environments through trial and error. This technique can be applied to various risk management scenarios:

- Dynamic Risk Mitigation: Develop AI systems that can adapt and adjust risk mitigation strategies in response to changing conditions.

- Optimized Decision-Making: Train AI agents to make optimal decisions in complex situations, such as portfolio management or resource allocation.

- Automated Response: Develop AI systems that can automatically respond to certain types of risks, such as cybersecurity threats or operational incidents.

The Future of AI in Risk Management

These AI techniques are just the tip of the iceberg. As AI technology continues to evolve, we can expect even more innovative applications in risk management. By embracing these advancements, organisations can gain a significant advantage in proactively mitigating risks and building resilience in an increasingly uncertain world. Moreover, the integration of AI in risk management is becoming essential for businesses that wish to thrive in the face of challenges and uncertainties.

Stay tuned for future blog posts that will explore specific use cases and applications of AI in risk management across various industries. We’ll discuss how different sectors can leverage AI techniques to enhance their risk management frameworks and ensure long-term sustainability.